long island tax calculator

As long as you do this accurately and on time you should be problem free. For all other areas of the UK please use the UK Salary Calculator.

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Overview of New York Taxes.

. You can use this tax calculator to. At this school 20 of the students live in college-owned -operated or -affiliated housing and 80 of students. If you wish to calculate your income tax in Scotland before the income tax rate change in 201718 you can use the pre 201718 Scottish Income Tax Calculator.

10 tax on people who live 184 days a year in the country. Premier Home Business Deluxe Online Premier Online and Self-Employed Online technical support by phone is free. 2022 Income Tax Calculator Québec.

Capital gains tax is the tax paid on profits you make from selling an investment for more than it was purchased for. Long Island University has a total undergraduate enrollment of 10403 fall 2020. Properties Over 25 million.

New York Property Tax Calculator. Estimate your federal and state income taxes. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022.

The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances. Province of residence Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon. Both accounts earn only interest income compounded annually.

Long-term capital gains are when you hold an investment for more than a year after purchased. The Canada Hourly Tax Calculator is updated for the 202223 tax year. Why Gusto Payroll and more Payroll.

WPRO-12 In addition to your current IRS tax withholding which is most likely based on your latest W-4 and based on your entries we suggest you withhold this additional tax amount in order to balance or reduce the taxes owed with your 2022 Tax Return. 2022 Income Tax Calculator British Columbia. RRSP contributions can help change your tax outcome.

You can calculate your Hourly take home pay based of your Hourly gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax TablesUse the simple hourly Canada tax calculator or switch to the advanced Canada hourly tax calculator to review NIS payments and income tax. 12 tax on. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

This Salary and PAYE calculator is purely for those subject to PAYE rules and regulation which falls under Scottish control. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes. Were proud to provide one of the most comprehensive free online tax calculators to our users.

Automatic deductions and filings direct deposits W-2s and 1099s. Short-term capital gains are treated as income and are taxed at your marginal. Local retailer fees on winnings from 100 to 500.

Get the inside scoop on what its really like to live. All federal and provincial taxes and surtaxes are taken into account however the calculator assumes that only the basic personal tax credit as well as the dividend tax credit and Canada employment amount if applicable are available. Contributions are made at the start of each contribution period.

Tax is deducted annually from the taxable account at the estimated marginal tax rate. There are plenty of reasons to buy a home in Suffolk County which sits at the eastern end of Long Island - but low property taxes is not one of them. Prince Edward Island tax bracket Prince Edward Island tax rates.

2022 free Québec income tax calculator to quickly estimate your provincial taxes. Your average tax rate is 1198 and your marginal tax rate is 22. Please note that we can only estimate your property tax based on median property taxes in your area.

30 tax on people who live less than 184 days a year in the country. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. That is due in part to high.

Calculate your expected refund or amount of owed tax. But these selling events can trigger significant long-term capital gains tax liabilities. The credit is nonrefundable.

You can claim a maximum of 100000 per tax year. That tax rate is 15 if youre married filing jointly with taxable income between 80000. Based on the data entered and the tax refund amount shown at WPRO-10 above we suggest you reduce your tax.

The typical Suffolk County homeowner pays 9157 annually in property taxes. Use our income tax calculator to find out what your take home pay will be in Colorado for the tax year. This marginal tax rate means.

Please check for the latest Real Estate Conveyance Tax Rates from the CT Department of Revenue Services Website. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Actual returns total annual income marginal tax rate and other factors may vary.

Long Island Fairfield County and Northern New Jersey. The calculator will show your tax savings based on the specified RRSP contribution amount. Connecticut Property Transfer Tax Calculator.

And a 52-week year. Check your eligibility for a variety of tax credits. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498.

Properties 800000 and Below. Start filing your tax return now. 2022 free British Columbia income tax calculator to quickly estimate your provincial taxes.

Georgia Property Tax Calculator. Short-term capital gains are when you buy an investment and sell it in a year or less. Use our handy calculator to crunch the numbers and estimate how RRSPs make a difference.

TAX DAY IS APRIL 17th - There are 221 days left. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022. Then deposit it as appropriate.

Long Island Cpa Accountant Www Abbelamarco Com Tax Preparation Business Tax Business Advisor

Property Tax Bills May Amount To A Lot Of Money And Can Be A Burden For Pennsylvania Residents No One Likes To Pay High Property Tax Estate Tax Home Appraisal

Staffing Company Owner Pleads Guilty To Payroll Tax Crimes Longisland Com

Income Tax Calculator Estimate Your Refund In Seconds For Free

Property Tax How To Calculate Local Considerations

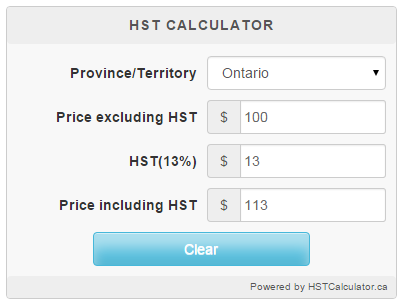

Ontario Hst Calculator Hstcalculator Ca

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

New York Paycheck Calculator Smartasset

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

New York Property Tax Calculator 2020 Empire Center For Public Policy

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Tax Calculator Estimate Your Income Tax For 2022 Free